Pub. KS-1223 Food Sales Tax Rate Reduction

This publication has been prepared by the Kansas Department of Revenue (KDOR) to assist you in understanding how Kansas sales and use tax applies to the retail food industry. Effective January 1, 2023, the state sales tax rate for food and food ingredients, and certain prepared food, will be reduced. In this publication you will find information on what is taxable at the full sales tax rate, what qualifies for the reduced sales tax rate, and other information of general interest to businesses. Our goal is to make collecting and paying sales tax as easy as possible and to help you avoid costly mistakes.

PDF printable copy is located here.

This booklet was written to help businesses, individuals, and anyone else who sells food and food ingredients and prepared food in Kansas to better understand the sales and use tax laws as they apply to their industry. The information contained in this guide is based on the Kansas laws that are effective on January 1, 2023.

In accordance with 2022 House Bill 2106, starting January 1, 2023, the state sales and use tax rate on food and food ingredients, and certain prepared food, will be reduced from 6.5% to 4.0%. Starting on January 1, 2024, the state sales tax rate will be reduced to 2.0%. And, starting on January 1, 2025, the state sales tax rate will be reduced to 0.0%.

It is important to note the sales tax on food and food ingredients, and certain prepared food, is not being repealed. Instead, the state sales tax rate is being reduced, over time, to zero. The reduction in the sales tax rate on food and food ingredients, and certain prepared food, only applies to the state portion of the sales tax rate. All local sales and use taxes still apply. This includes cities, counties, and political subdivisions along with special jurisdictions within the cities, counties, and political subdivisions, community improvement districts, transportation development districts, and STAR bond project districts.

Use this booklet only as a general guide. It is not an exhaustive study of all sales tax or the law. If you have questions or need additional information, please contact:

Kansas Department of Revenue Office of Policy and Research

109 SW 9th Street

P O Box 3506

Topeka, KS 66601-3506

email: KDOR_Policy&Research@ks.gov

Additional information is available through the Department’s website at: www.ksrevenue.gov. This includes information regarding:

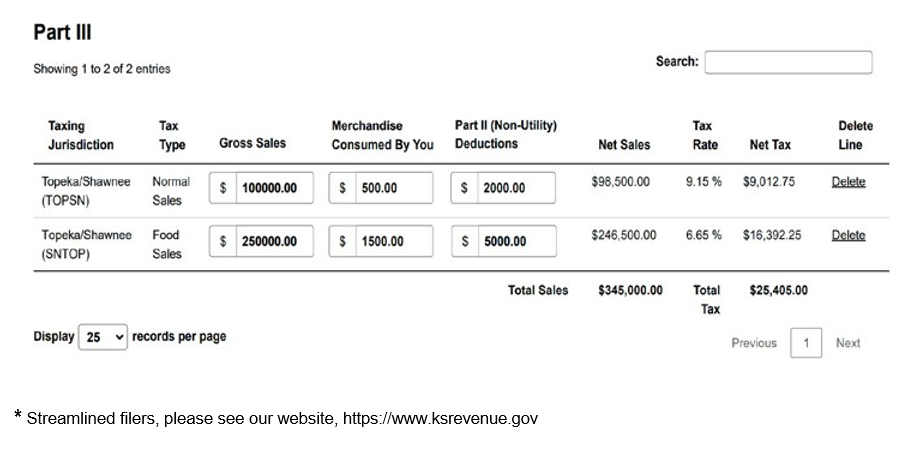

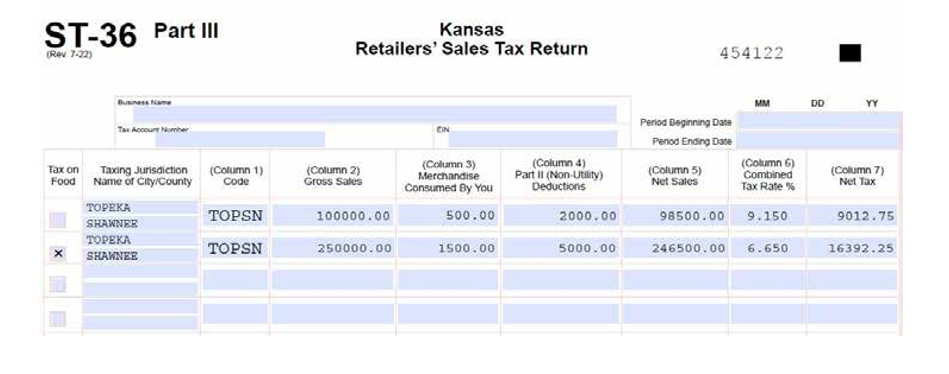

- ST-36 Retailers’ Sales Tax Return and instructions

- Kansas Customer Service Center and electronic filing

- Publication KS-1510 Kansas Sales and Compensating Use Tax

- Publication KS-1520 Kansas Exemption Certificates

- Publication KS-1700 Sales and Use Tax Jurisdiction Code Booklet

TABLE OF CONTENTS

- KANSAS SALES AND USE TAX

- OVERVIEW OF KANSAS SALES TAX ON FOOD

- WHAT IS FOOD AND FOOD INGREDIENTS

- WHAT IS NOT FOOD AND FOOD INGREDIENTS

- WHAT IS PREPARED FOOD

- WHAT IS NOT PREPARED FOOD.

- PREPARED FOOD TAXED AT THE REDUCED STATE SALES TAX RATE

- SUMMARY OF WHAT TAX RATE APPLIES

- COMMON FOOD SELLING SITUATIONS

- SPECIAL SITUATIONS

- APPENDICES

- TAXPAYER ASSISTANCE

KANSAS SALES AND USE TAX

Kansas is one of 45 states plus the District of Columbia that levy a sales tax and the companion compensating use tax. Alaska, Delaware, Montana, New Hampshire, and Oregon do not have a general sales or use tax. The Kansas Retailers’ Sales Tax was enacted in 1937 at the rate of 2%, increasing over the years to the current state rate of 6.5%. In addition to the state sales tax, counties and cities in Kansas have the option of imposing a local sales tax. Although these are local taxes, the law requires retailers selling in Kansas to collect from their customers both the state and local sales tax. The state and local sales tax rate(s) added together are called the “combined rate of sales tax.” Local tax applies whenever a state tax is due if the tax situs (jurisdiction) for the sale is in a county or city with a local tax (with a few exceptions).

SALES THAT ARE TAXED

Kansas sales tax generally applies to the retail sale, rental, or lease of tangible personal property, and enumerated services provided within the state.

Tangible personal property is defined, in part, by K.S.A. 79-3602(pp) which states, in part: "Tangible personal property" means personal property that can be seen, weighed, measured, felt, or touched, or that is in any other manner perceptible to the senses.”

COMPENSATING USE TAX

A purchaser who is the end user of the tangible personal property they buy is responsible for accruing and remitting consumers’ compensating use tax when Kansas sales or retailers’ compensating use tax has not been paid, or when the amount of tax paid is not equal to the amount that would have been paid if the sale had occurred in Kansas. When the purchaser is a business, this typically means purchases of things necessary to run the business, such as tools of the trade, equipment used in the business, display cabinets, freezers, and many other items, from an out-of-state vendor. Just like sales tax, compensating use tax applies to the total amount of the purchase price including administration charges, shipping or handling charges, fees or other charges applied to the sale by the out-of-state vendor. (For more information about compensating use tax see Publication KS-1510, Kansas Sales Tax and Compensating Use Tax.)

SALES TAX RATE (DESTINATION SOURCING)

Kansas is a destination-based sourcing state. Under the sourcing rules, the rate of sales tax due on in-state sales will be the combined state and local sales tax rate in effect where the customer (end user) takes delivery/possession of the purchased item(s). The seller collects the sales tax rate in effect at the seller’s place of business for over-the-counter transactions.

If the seller ships or delivers the item(s) to the purchaser, the seller will collect the combined sales tax rate in effect at the location where the purchaser receives the item(s). This will be the location where the seller delivers the item(s) to the purchaser or, if the seller ships the item(s), it will be the customer’s shipping address.

TAX BASE

The Kansas sales tax base is the amount of the gross receipts charged to the customer (end user). Gross receipts means the total selling price including any fees, overhead charges, and delivery including shipping and handling. (See Publication KS-1510, Kansas Sales Tax and Compensating Use Tax, for more information.)

ITEM PURCHASED FOR RESALE

Kansas sales tax and use tax should be paid one time by the end user (final consumer). This means a business in Kansas can purchase inventory items that will be resold to their customers without sales or use tax. To purchase inventory without sales tax a retailer should provide the vendor a resale exemption certificate (ST-28A) or possibly an ingredient or component part exemption certificate (ST-28D). The vendor requires this as proof of exemption in case they are audited. A retailer should download the appropriate exemption certificate from the Kansas Department of Revenue website (https://www.ksrevenue.gov/prpecwelcome.html), complete the certificate using their sales tax registration number, sign the certificate, and give the completed exemption certificate to the vendor. (See publications KS-1520, Kansas Exemption Certificates and KS-1510, Kansas Sales Tax and Compensating Use Tax for more information.)

HOW OFTEN TO FILE SALES OR USE TAX RETURN

The filing frequency for sales or use tax returns is based on how much sales tax is collected in a calendar year or how much compensating use tax is paid in a calendar year. The Department uses information provided when registering for a sales or use tax registration number to determine and assign the appropriate filing frequency. (See Publication KS-1510 for more information.)

| ANNUAL TAX DUE | FILING FREQUENCY | RETURN DUE DATE |

|---|---|---|

| $0—$1000 | Annual | On or before January 25th of the following year. |

| $1000.01—$5,000 | Quarterly | On or before the 25th of the month following the end of the calendar quarter—April 25, July 25, October 25, January 25. |

| $5,000.01— and over | Monthly * Seasonal |

On or before the 25th of the following month (e.g., a March return is due by April 25). |

* If your business is seasonal, you will file monthly during the period of business operation.

OVERVIEW OF KANSAS SALES TAX ON FOOD

Effective January 1, 2023, the Kansas state portion of sales tax on food and food ingredients for human consumption, and certain prepared food, will be reduced, in phases, to 0%. Starting on January 1, 2023, the state sales tax rate will be reduced from 6.5% to 4%. Starting on January 1, 2024, the state rate will be reduced from 4% to 2%. And, starting on January 1, 2025, the state rate will be reduced from 2% to 0%.

Generally

For Kansas state sales tax purposes, food products are separated into two categories:

- Food and food ingredients and

- Prepared food.

The rate of state sales tax to be collected by the retailer on the sale of a food product is based on whether the food product is a food and food ingredient or prepared food, and is determined item-by-item.

- The reduced state sales tax applies only to food and food ingredients (except in certain limited situations explained later in this publication).

- Prepared food continues to be taxed at the full 6.5% state sales tax rate.

- The rate of local sales taxes imposed by cities and counties is not affected. Sales of food and food ingredients and prepared food, remain subject to sales taxes imposed by cities and counties.

Food and Food Ingredients

Food and food ingredients are typically thought of as “grocery store food items,” especially foods prepared and packaged by a manufacturer or processor, and as fresh, raw food that may be purchased from a bulk vendor or from a local seller, such as a farmers’ market. A simple general rule is that if a retailer purchases a food product from a manufacturer, wholesaler, or distributor, for the purpose of reselling the food product to a final user or consumer, and does not alter or change the food product it received from the manufacturer, wholesaler, or distributor in any way prior to selling the food product to the final consumer, the food product is likely a food and food ingredient and is taxed at the reduced state sales tax rate. Most “grocery store food items” fall into this category.

Prepared Food

A prime example of prepared food is a “restaurant meal.” A simple general rule is that if a retailer purchases a food product from a manufacturer, wholesaler, or distributor, for the purpose of reselling the food product to a final user or consumer, and alters or changes the food product it received from the manufacturer, wholesaler, or distributor in any way prior to selling the food product to the final user or consumer, the food product is prepared food and is taxed at the full state sales tax rate. Most restaurant meals fall into this category.

Kansas law specifically defines what is, and what is not, prepared food.

Prepared food does include:

- Food sold in a heated state or heated by the seller; or

- Food items that are a result of the seller mixing or combining two or more food and food ingredients and selling the mixture or combination as a single item; or

- Food sold with eating utensils provided by the seller.

Prepared food does not include the following:

- Food that is only cut, repackaged, or pasteurized by the seller; or

- Eggs, fish, meat, poultry, and foods containing these raw animal foods requiring cooking by the consumer as recommended by the Food and Drug Administration.

There are also some items of prepared food that are exceptions to the rule and are not taxed as prepared food.

When a single price is charged for a combination of food and food ingredients and prepared food, the full sales tax rate should be charged.

WHAT IS FOOD AND FOOD INGREDIENTS

[REDUCED STATE SALES TAX RATE]

While typically thought of as “grocery store items,” Kansas law provides a definition for what IS food and food ingredients. Specifically, K.S.A. 79-3602(n) provides:

(n) "Food and food ingredients" means substances, whether in liquid, concentrated, solid, frozen, dried or dehydrated form, that are sold for ingestion or chewing by humans and are consumed for their taste or nutritional value. “Food and food ingredients” includes bottled water, candy, dietary supplements, food sold through vending machines and soft drinks. “Food and food ingredients” does not include alcoholic beverages or tobacco.

Some of the items specifically included in the definition of food and food ingredients are further defined in other subsections of K.S.A. 79-3602. Specifically:

Bottled Water

(jjj)(1) “Bottled water” means water that is placed in a safety sealed container or package for human consumption. “Bottled water” is calorie free and does not contain sweeteners or other additives, except that it may contain:

(A) Antimicrobial agents;

(B) fluoride;

(C) carbonation;

(D) vitamins, minerals and electrolytes;

(E) oxygen;

(F) preservatives; or

(G) only those flavors, extracts or essences derived from a spice or fruit.

(2) “Bottled water” includes water that is delivered to the buyer in a reusable container that is not sold with the water.

Candy

(lll) (1) “Candy” means a preparation of sugar, honey or other natural or artificial sweeteners in combination with chocolate, fruits, nuts or other ingredients or flavorings in the form of bars, drops or pieces.

(2) “Candy” does not include any preparation containing flour and shall require no refrigeration.

Dietary Supplements

(mmm) “Dietary supplement” means the same as defined in K.S.A. 79-3606(jjj), and amendments thereto.

K.S.A. 79-3606(jjj) As used in this subsection, “dietary supplement” means any product, other than tobacco, intended to supplement the diet that: (1) Contains one or more of the following dietary ingredients: A vitamin, a mineral, an herb or other botanical, an amino acid, a dietary substance for use by humans to supplement the diet by increasing the total dietary intake or a concentrate, metabolite, constituent, extract or combination of any such ingredient; (2) is intended for ingestion in tablet, capsule, powder, softgel, gelcap or liquid form, or if not intended for ingestion, in such a form, is not represented as conventional food and is not represented for use as a sole item of a meal or of the diet; and (3) is required to be labeled as a dietary supplement, identifiable by the supplemental facts box found on the label and as required pursuant to 21 C.F.R. § 101.36;

Food Sold Through Vending Machines

(nnn) “Food sold through vending machines” means food dispensed from a machine or other mechanical device that accepts payment.

Soft Drinks

(ppp) (1) “Soft drinks” means nonalcoholic beverages that contain natural or artificial sweeteners.

(2) “Soft drinks” does not include beverages that contain milk or milk products, soy, rice or similar milk substitutes or beverages that are greater than 50% vegetable or fruit juice by volume.

Manufactured Food and Food Ingredients

Food items prepared and produced by a food manufacturer or processor are generally considered to be food and food ingredients when sold by a retailer to a final consumer. A business whose proper primary North American Industry Classification System (NAICS) code is manufacturing in subsector 311 is in the food manufacturing subsector. Industries in the food manufacturing subsector and food processors, transform livestock and other agricultural products into products for intermediate or final consumption. The industry groups are distinguished by the raw materials (generally of animal or plant origin) processed into food products. A business in manufacturing subsector 311 frequently mixes or combines two or more food and food ingredients to make a finished product. When these food products are sold by the manufacturer or processor to wholesalers or distributors for resale to retailers and, ultimately, by retailers to final consumers, they are treated as a single food and food ingredient item in the hands of the wholesaler, distributor, or retailer, and as a single food item when sold by a retailer to the final consumer.

Bakery items, including bread, rolls, buns, biscuits, bagels, croissants, pastries, donuts, danish, cakes, tortes, pies, tarts, muffins, bars, cookies and tortillas, are a special category.

Regardless of who produces a bakery item, a manufacturer or a retailer, once produced the bakery item is considered a single food and food ingredient item.

WHAT IS NOT FOOD AND FOOD INGREDIENTS

[FULL STATE SALES TAX RATE]

Kansas law also provides a definition for what IS NOT food and food ingredients. As noted above, K.S.A. 79-3602(n) provides, in part, that:

“Food and food ingredients” does not include alcoholic beverages or tobacco.

K.S.A. 79-3602 also defines the terms “alcoholic beverage” and “tobacco.” Specifically, K.S.A. 79-3602(c) provides:

(c) “Alcoholic beverages” means beverages that are suitable for human consumption and contain 0.05% or more of alcohol by volume.

K.S.A. 79-3602(rr) provides:

(rr) “Tobacco” means cigarettes, cigars, chewing or pipe tobacco or any other item that contains tobacco.

Products that are often thought of as tobacco or tobacco replacements are treated in the same manner as tobacco for sales tax purposes. These products include items like e-cigarettes or vaping products designed to be used in a manner similar to a traditional cigarette. E-liquids typically come in prefilled or refillable cartridges. This material may include nicotine, cannabis (THC, CBD), flavoring, solvents, or other substances. Since these items are not customarily purchased for their nutritional value and are inhaled rather than ingested, they are not food and food ingredients and therefore are taxed at the full state sales tax rate.

WHAT IS PREPARED FOOD

[FULL STATE SALES TAX RATE]

As with food and food ingredients, Kansas law provides a definition of what IS “prepared food.” Specifically, K.S.A. 79- 3602(ooo)(1) provides:

(ooo) (1) “Prepared food” means:

(A) Food sold in a heated state or heated by the seller;

(B) two or more food ingredients mixed or combined by the seller for sale as a single item; or

(C) food sold with eating utensils provided by the seller, including, but not limited to, plates, knives, forks, spoons, glasses, cups, napkins or straws. A plate does not include a container or packaging used to transport the food.

Heated State or Heated by the Seller

Prepared food includes food sold in a heated state or heated by the seller. Food is sold in a heated state if it is sold at a temperature higher than the air of the room or place where the item is sold. Food is considered “heated by the seller” if the seller heated the food at any time before the sale, even if the food has cooled after heating. Prepared food includes food that is served hot even if the food was not otherwise prepared by the seller. Heating includes, but is not limited to, baking, boiling, smoking, cooking, microwaving or any other method used to heat food. The heating of prepared foods may also occur through use of items such as heat lamps and chaffing dishes. The heating may occur at premises other than the sales location.

It is important to note the full state sales tax rate imposed on prepared food does not apply to bakery items that are sold, as a single item, in a heated state or heated by the seller if sold without eating utensils. While bakery items sold in a heated state or heated by the seller are prepared food, under the provisions of New Section 1(b)(3) of 2022 House Bill 2106, they are nevertheless taxed at the reduced state sales tax rate when sold without eating utensils. See Prepared Food Taxed at the Reduced State Sales Tax Rate.

EXAMPLE: At a fast-food restaurant, hamburgers are cooked and placed in a warming tray. The hamburgers are prepared food because they are heated by the seller, the fast-food restaurant.

EXAMPLE: At a convenience store a customer selects a sandwich produced by a manufacturer from the store’s refrigerator case and the convenience store employee uses the convenience store’s microwave to heat the sandwich for the customer. The sandwich is prepared food because it is heated by the seller, the convenience store.

EXAMPLE: At a convenience store, a customer selects a sandwich produced by a manufacturer from the store’s refrigerator case and heats the sandwich, using the store’s microwave which is available for customer use. The sandwich is not prepared food because it is not heated by the seller, the convenience store.

EXAMPLE: A food truck serves barbequed brisket that is smoked at a facility away from the food truck’s mobile location. The brisket is prepared food because it is heated by the food truck operators, even though the heating (smoking) occurred at a location other than the location of the sale.

EXAMPLE: A bakery makes pies. After production, the bakery heats a pie and sells it to a customer. The pie is prepared food because it is heated by the bakery but, as a bakery item, it is taxed at the reduced state sales tax rate, and the reduced rate applies despite the fact the pie is heated, if it is sold without eating utensils. See Prepared Food Taxed at the Reduced State Sales Tax Rate.

Ingredients Mixed or Combined by the Seller

Prepared food includes foods mixed or combined by the seller for sale as a single item. A seller who mixes or combines two or more food and food ingredients and sells the mixture or combination as a single item may be a manufacturer, or the seller may be a retailer. Food products that are a mixture or combination of two or more food and food ingredients for sale as a single item that are produced by a manufacturer are generally characterized as food and food ingredients. See What Is Food and Food Ingredients – Manufactured Food and Food Ingredients. On the other hand, food products that are a mixture or combination of two or more food and food ingredients for sale as a single item that are made by a food retailer are generally characterized as prepared food.

It is also important to note the full state sales tax rate imposed on food mixed or combined by the seller for sale as a single item does not apply to bakery items, sold as a single item, whether produced by a manufacturer or by a retailer, when sold without eating utensils. While bakery items are prepared food because they consist of two or more food and food ingredients mixed or combined by the seller for sale as a single item, under the provisions of New Section 1(b)(3) of 2022 House Bill 2106, they are nevertheless taxed at the reduced state sales tax rate when sold without eating utensils. See Prepared Food Sold at the Reduced State Sales Tax Rate.

EXAMPLE: At a grocery store, a customer purchases cans of vegetable soup and jars of spaghetti sauce produced by a manufacturer. The cans of soup and jars of sauce contain two or more food and food ingredients mixed or combined for sale as a single item. But, because the cans of soup and jars of sauce were produced by a manufacturer and purchased by the grocery store for the purpose of resale to the final consumer, they are sold by the grocery store as a single item. As a result, they are not prepared food.

EXAMPLE: A grocery store purchases cans of soup from a manufacturer for sale to its customers. However, the grocery store takes some of the cans of soup out of its inventory and mixes the soup with other ingredients taken from its produce section and sells the combination on its deli section buffet. Because the soup sold by the grocery store consists of two or more food and food ingredients mixed or combined by the seller for sale as a single item, the deli soup is prepared food.

EXAMPLE: At a bakery, a customer purchases a loaf of bread and a cake made by the bakery. The bread and cake are prepared food because they consist of two or more food and food ingredients mixed or combined by the seller for sale as a single item but, as bakery items, they are taxed at the reduced state sales tax rate, when sold as a single item and without eating utensils. See Prepared Food Taxed at the Reduced State Sales Tax Rate.

EXAMPLE: At a bakery, a customer selects a loaf of bread which the bakery uses to make sandwiches for the customer. The sandwiches are prepared food because they consist of two or more food and food ingredients mixed or combined by the seller for sale as a single item.

Eating Utensils “Provided by Seller”

Prepared food includes food sold with eating utensils provided by the seller. “Utensil” includes a plate, bowl, knife, fork, spoon, glass, cup, napkin, or a straw. “Plate” does not include a container or packaging used to transport the food. A purchaser’s choice not to use a provided utensil does not affect whether an item is prepared food.

Eating utensils are “provided by the seller” when the seller’s business practice is to physically give or hand eating utensils to purchasers. In addition, eating utensils are “provided by the seller” when the seller arranges for eating utensils to specifically accompany or be added to the food being sold. A container or packaging to be used by the purchaser to transport food is not an eating utensil “provided by the seller” regardless of whether the seller physically gives or hands the container or packaging to the purchaser, or places containers and/or packaging to be used to transport food in a location readily accessible by, and convenient for, purchasers.

EXAMPLE: At an ice cream store, a customer purchases a scoop of ice cream which the seller serves in a reusable ceramic bowl that is physically given or handed to the customer, along with a spoon. The bowl of ice cream is prepared food because it is sold with eating utensils (bowl and spoon) provided by the seller.

EXAMPLE: At a restaurant, a customer purchases a can of specialty soda. The restaurant physically gives or hands the customer a cup, a lid, and a straw. The canned soda is prepared food because it is sold with eating utensils provided by the seller.

EXAMPLE: At a grocery store deli buffet, a customer selects a brownie that has been pre-plated and/or pre- arranged with a fork and napkin. The brownie is prepared food because it is sold with eating utensils provided by the seller.

EXAMPLE: At a bakery, a customer purchases a bagel and a container of cream cheese. The bakery physically gives or hands a knife and a napkin to the customer, or arranges for a knife and napkin to specifically accompany or be added to the bagel and cream cheese. The bagel and cream cheese are prepared food because they are sold with eating utensils “provided by the seller”.

EXAMPLE: At a bakery, a customer purchases a bagel and a container of cream cheese. The bakery does not physically give or hand utensils to the customer, and it does not arrange for eating utensils to specifically accompany or be added to the bagel and cream cheese. Instead, the bakery has placed knives, forks, spoons, and napkins in a location readily accessible by, and convenient for, purchasers. The bagel and cream cheese are not prepared food because they are not sold with eating utensils “provided by the seller”. Utensils that are merely made available by the seller are not “provided by the seller” for purposes of the statutory definition.

EXAMPLE: At a grocery store deli’s salad bar, a customer selects from various individual items (lettuce, tomatoes, onions, olives, cucumbers, etc.) to make themselves a salad. The deli does not physically give or hand eating utensils to customers, nor does it arrange for eating utensils to specifically accompany or be added to the food being sold. The deli does place, in a location readily accessible by and convenient for purchasers, containers for purchasers to use to transport the food. The salad made by the customer is not prepared food because a container used by a purchaser to transport food is not an eating utensil “provided by the seller.”

Restatement of What IS Prepared Food

Restating the statutory provisions, prepared food is food that is:

- Sold in a heated state or heated by the seller; OR

- Two or more food ingredients mixed or combined by the seller for sale as a single item; OR

- Sold with eating utensils provided by the seller.

WHAT IS NOT PREPARED FOOD

[REDUCED STATE SALES TAX RATE]

Kansas law also provides a definition of what IS NOT “prepared food.” Items in this category are taxed at the reduced state sales tax rate. Specifically, K.S.A. 79-3602(ooo) (2) provides:

(ooo)(2) “Prepared food” does not include:

(A) Food that is only cut, repackaged or pasteurized by the seller; or

(B) eggs, fish, meat, poultry or foods containing these raw animal foods that require cooking by the consumer as recommended by the food and drug administration in chapter 3, part 401.11 of the food and drug administration food code so as to prevent food borne illnesses.

Food Cut, Repackaged or Pasteurized by the Seller

Prepared food does not include food that is only cut, repackaged, or pasteurized by the seller. Heating the food, mixing or combining the food for sale as a single item, or providing utensils with the food will cause the food to be prepared food.

EXAMPLE: A grocery store purchases heads of lettuce and carrots, in bulk, from local growers or vegetable wholesalers or distributors. It then cuts and repackages the lettuce and separately repackages the carrots. The lettuce and carrots are not prepared food because they are only cut and/or repackaged by the seller as separate items.

EXAMPLE: A full-service restaurant purchases heads of lettuce, tomatoes, carrots, cucumbers, and onions, in bulk, from local growers. It then cuts and combines these items to make salads. Because the lettuce, tomatoes, carrots, cucumbers, and onions have been combined by the seller and will be sold as a single item they are prepared food.

EXAMPLE: A deli purchases processed salami from a manufacturer. It then cuts some of the salami and repackages it for sale at a per package price. In addition, the deli will cut the salami to a weight or amount requested by a customer. The salami is not prepared food because it is only cut and/or repackaged by the deli.

Raw Animal Foods that Require Cooking by the Consumer To Prevent Food Borne Illness

Raw animal foods that require cooking by the consumer, as recommended by the Food and Drug Administration in Chapter 3, Part 401.11 of the Food and Drug Administration Food Code so as to prevent food borne illnesses, include eggs, fish, meat, poultry, or foods containing these raw animal foods.

EXAMPLE: A butcher shop or meat market sells raw steaks. Because the steaks require cooking by the consumer as recommended by the Food and Drug Administration in Chapter 3, Part 401.11 of the Food and Drug Administration Food Code so as to prevent food borne illnesses, the steaks are not prepared food.

EXAMPLE: A butcher shop or meat market sells steak kabobs, which are a combination of raw steak and vegetables. Because the steak kabobs require cooking by the consumer as recommended by the Food and Drug Administration in Chapter 3, Part 401.11 of the Food and Drug Administration Food Code so as to prevent food borne illnesses, the steak kabobs are not prepared food.

PREPARED FOOD TAXED AT THE REDUCED STATE SALES TAX RATE

The reduced state sales tax rate applies to some, specifically defined, prepared food. New Section 1 of 2022 House Bill 2106 provides (with some paraphrasing for clarity), as follows:

(b) [The reduced sales tax rate] shall not apply to prepared food unless [the prepared food is] sold without eating utensils provided by the seller and [is in one of the categories] described below:

(1) Food sold by a seller whose proper primary NAICS classification is manufacturing in sector 311, except subsector 3118 (bakeries);

(2)(A) food sold in an unheated state by weight or volume as a single item; or

(B) only meat or seafood sold in an unheated state by weight or volume as a single item;

(3) bakery items, including bread, rolls, buns, biscuits, bagels, croissants, pastries, donuts, danish, cakes, tortes, pies, tarts, muffins, bars, cookies and tortillas; or

(4) food sold that ordinarily requires additional cooking, as opposed to just reheating, by the consumer prior to consumption.

There are two important things to note about the new provision. First, it only applies to prepared food. It does not apply to food and food ingredients, and it does not apply to food items that have been defined by statute to not be prepared food.

Second, the new provision changes the rate of tax which is to be applied to the specifically enumerated prepared food items. It does not change the characterization of these items. The prepared food items that are enumerated qualify for an “exception” to the imposition of the full state sales tax rate on prepared food.

Restating the new provision, the items listed in subsection (b) of New Section 1 of 2022 House Bill 2106 are to be taxed as prepared food only if they are sold with eating utensils provided by the seller. Please refer to the section Eating Utensils Provided by the Seller, earlier in this publication. If they are sold without eating utensils, these items are taxed at the reduced state sales tax rate.

Food Sold by a Manufacturer Directly to a Consumer

Food products manufactured or processed by a food manufacturer or processor are typically sold to wholesalers or distributors for resale to retailers and, ultimately, by retailers to final consumers. See What Is Food and Food Ingredients – Manufactured Food and Food Ingredients. However, some manufacturers or processors do make direct sales of their food products to final consumers. In these cases, the food products being sold are prepared food because they are mixed or combined by the seller for sale as a single item.

Prepared food sold without eating utensils by a manufacturer to a final user or consumer is taxed at the reduced state sales tax rate.

EXAMPLE: A large company whose proper primary NAICS is manufacturing in subsector 311 has a retail outlet at or near one of its facilities which sells many of its products. If eating utensils are not provided by the company, the sales of its products through its retail outlet are taxed at the reduced state sales tax rate.

Unheated Food Sold by Weight or Volume as a Single Item

Subsections (b)(2)(A) and (B) of New Section 1 of 2022 House Bill 2106 refer to food sold by weight or volume as a single item. Food sold by weight or volume means that the price will vary based on the weight or volume of the product a purchaser selects. For example, the product is sold by the pound and the price is determined by multiplying the weight selected by the price per pound.

Prepared food sold without eating utensils and in an unheated state, by weight or volume, as a single item, is taxed at the reduced state sales tax rate.

EXAMPLE: A deli prepares potato salad in bulk quantities. It sells the potato salad by the weight requested by each purchaser, placing that amount in a container sized to accommodate the chosen weight. If eating utensils are not provided by the deli, the potato salad is taxed at the reduced state sales tax rate because it is sold at a variable unit price determined by weight.

EXAMPLE: A deli prepares potato salad in bulk quantities. It packages the potato salad in uniform containers, but the containers are priced for sale according to the weight of each individual container. If eating utensils are not provided by the deli, the potato salad is taxed at the reduced state sales tax rate because it is sold for a variable unit price determined by the weight of each individual container.

EXAMPLE: A deli prepares potato salad in bulk quantities. It packages the potato salad in uniform containers which are sold at a standard price per container. Although the potato salad is not heated, and eating utensils are not provided by the deli, the potato salad is taxed at the full sales tax rate because it is sold for a standard unit price per container and not for a variable unit price determined by the weight of each individual container.

Bakery Items

Subsection (b)(3) of New Section 1 of 2022 House Bill 2106 refers to bakery items. As defined in the statute, bakery items include bread, rolls, buns, biscuits, bagels, croissants, pastries, donuts, danish, cakes, tortes, pies, tarts, muffins, bars, cookies and tortillas.

For food products in this category, it is the nature of the item that matters, not who makes or produces it, or who sells it.

Bakery items, sold as single items, are taxed at the reduced state sales tax rate.

EXAMPLE: A local bakery makes several kinds of breads and cinnamon rolls which they sell at retail. If eating utensils are not provided by the bakery, the breads and cinnamon rolls are taxed at the reduced state sales tax rate, even if heated by the bakery at the time of sale to the purchaser.

EXAMPLE: A local bakery makes several kinds of breads which they sell at retail. They also use some of the bread they have made to prepare sandwiches for purchasers. Although eating utensils are not provided by the bakery, and single bakery items are taxed at the reduced state sales tax rate, a sandwich is taxed at the full state sales tax rate because it is a mixture or combination of two or more food and food ingredients prepared by the bakery and sold as a single item which does not qualify for the exception.

Food That Ordinarily Requires Cooking

Subsection (b)(4) of New Section 1 of 2022 House Bill 2106 refers to food sold that ordinarily requires additional cooking, as opposed to just reheating, by the consumer prior to consumption.

Prepared food that ordinarily requires cooking, and is sold without eating utensils, is taxed at the reduced state sales tax rate.

EXAMPLE: At a specialty store, a customer purchases a take-and-bake pizza (made with precooked meat and no eggs). If eating utensils are not provided by the specialty store, the take-and-bake pizza is taxed at the reduced state sales tax rate because it requires cooking.

Restatement

Restating the definitions found in New Section 1 of 2022 House Bill 2106 and providing additional clarity, to be defined or considered a prepared food that will be taxed at the reduced state sales tax rate, the prepared food must meet the following criteria:

1. The prepared food must be sold without eating utensils provided by the seller. Eating utensils include items such as:

- plates

- knives

- forks

- spoons

- glasses

- cups

- napkins

- straws

See Eating Utensils “Provided by Seller” earlier in this publication.

AND

2. The prepared food must be one of the following:

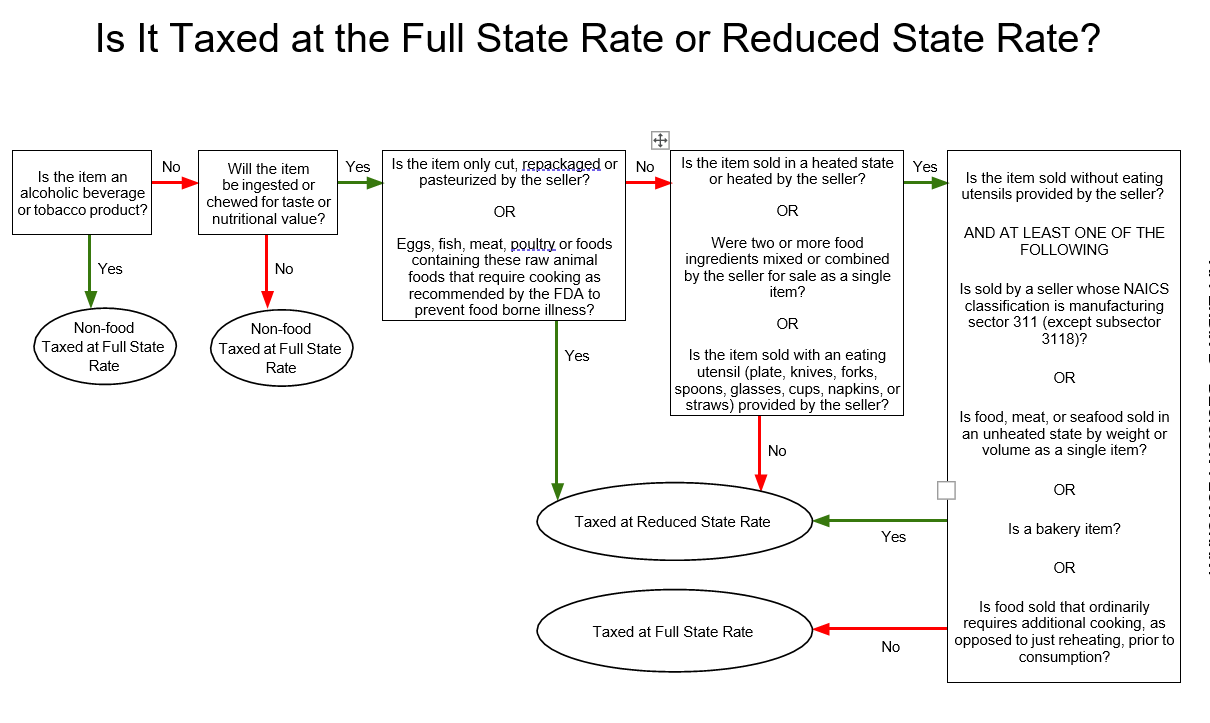

SUMMARY OF WHAT TAX RATE APPLIES

To determine the state sales tax rate that applies, follow these rules:

The reduced Kansas state sales tax rate applies to food and food ingredients.

The full Kansas state sales tax rate applies to most prepared food.

If food is only cut, repackaged, or pasteurized by the seller the food is NOT prepared food, and the reduced state sales tax rate applies.

If food is eggs, fish, meat, poultry, or foods containing these raw animal foods that require cooking by the consumer as recommended by the Food and Drug Administration in Chapter 3, Part 401.11 of the Food and Drug Administration Food Code so as to prevent food borne illnesses, the food is NOT prepared food, and the reduced state sales tax rate applies.

If food is sold in a heated state or heated by the seller it IS prepared food and will be taxed at the full state sales tax rate.

If food sold contains two or more food ingredients mixed or combined by the seller for sale as a single item, it IS prepared food and will be taxed at the full sales tax rate.

If food is sold with eating utensils provided by the seller, it IS prepared food and will be taxed at the full sales tax rate.

HOWEVER, the reduced state sales tax rate applies to some, specifically defined prepared food. The reduced state sales tax rate applies IF:

Eating utensils are NOT provided by the seller

AND

The food is sold by a seller whose proper primary NAICS is manufacturing in subsector 311, except subsector 3118 (bakeries);

OR

The food, (including meat or seafood), is sold in an unheated state by weight or volume as a single item;

OR

The food is bakery items, including bread, rolls, buns, biscuits, bagels, croissants, pastries, donuts, danish, cakes, tortes, pies, tarts, muffins, bars, cookies and tortillas;

OR

The food sold ordinarily requires additional cooking, as opposed to just reheating, by the consumer prior to consumption. When a single price is charged for a combination of food and food ingredients and prepared food, the full sales tax rate should be charged.

For more assistance, see APPENDIX B – DECISION FLOWCHART.

COMMON FOOD SELLING SITUATIONS

GENERALLY

The rate of state sales tax to be collected by the retailer on the sale of a food product is based on whether the food product is a food and food ingredient or prepared food and is determined item-by-item.

Food and food ingredients are taxed at the reduced state sales tax rate. Most prepared food is taxed at the full state sales tax rate.

The examples below address common situations that food sellers may encounter. The examples should help food sellers determine whether the food products they are selling are food and food ingredients or prepared food, and, accordingly, what state sales tax rate should be used.

GROCERY STORES / SUPERMARKETS

A grocery store is a store that sells food, drinks, and household supplies. A supermarket is a store that has as its central focus the sale of food and drinks, but which devotes more shelf space to other items, such as personal care items, cookware, and small kitchen appliances.

Sales made by grocery stores or supermarkets may be of food and food ingredients, prepared food, non-food items, or any combination thereof. Sales of food and food ingredients are taxed at the reduced state sales tax rate. Sales of most prepared food and sales of non-food items do not qualify for the reduced state sales tax rate, and instead are subject to sales tax at the full state rate.

EXAMPLE: At a grocery store, a customer purchases a box of cereal, a gallon of milk, and a bag of sugar. The grocery store does not provide eating utensils. All these items will be taxed at the reduced state sales tax rate because they are not heated by the grocery store, they are not a mixture or combination of two or more food and food ingredients prepared by the grocery store and sold as a single item, and the grocery store does not provide eating utensils.

EXAMPLE: In addition to shelves, refrigeration units, and freezer cases, a grocery store has a “deli” section. The deli does not provide eating utensils. A customer purchases a package of pastrami (produced by a manufacturer) which the grocery store only cuts and repackages, and some hot fried chicken. The pastrami qualifies as food and food ingredients subject to the reduced state sales tax rate because the grocery store’s deli section only cuts and repackages the pastrami. See What Is Not Prepared Food. The chicken is prepared food and will be taxed at the full state sales tax rate because the chicken is heated by the grocery store. See What Is Prepared Food.

EXAMPLE: At a grocery store, a customer purchases a family pack of raw steaks, a bag of mixed salad (produced by a manufacturer), a container of potato salad from the deli (made by the deli and sold at a standard unit price per container), and a 2-liter bottle of soda. The grocery store does not provide eating utensils. The family pack of raw steaks is food and food ingredients and will be taxed at the reduced state sales tax rate because raw meat that requires cooking by the consumer is not prepared food. See What Is Not Prepared Food. The bag of mixed salad is food and food ingredients and will be taxed at the reduced state sales tax rate because it is not heated by the grocery store, it is not a mixture or combination of two or more food and food ingredients prepared by the grocery store and sold as a single item, and the grocery store does not provide eating utensils. The container of potato salad is prepared food and will be taxed at the full state sales tax rate because it is a mixture or combination of two or more food and food ingredients prepared by the grocery store and sold as a single item. See What Is Prepared Food. The bottled soft drink will be taxed at the reduced state sales tax rate because it is defined by statute to be a food and food ingredient.

EXAMPLE: At a supermarket, a customer purchases an unheated Mediterranean dinner (made in the deli) that includes a bottled soft drink for one price. The supermarket deli does provide eating utensils. See What Is Prepared Food – Eating Utensils “Provided by Seller”. The customer also purchases a bottle of pain relief tablets and some household cleaners. The Mediterranean dinner is prepared food and will be taxed at the full state sales tax rate because the dinner sold by the supermarket deli is a mixture or combination of two or more food and food ingredients prepared by the supermarket and sold as a single item and/ or the supermarket provides eating utensils. See What Is Prepared Food. Although the bottled soft drink is defined by statute to be a food and food ingredient and would be taxed at the reduced state sales tax rate if purchased separately, when both the prepared meal and the bottled soft drink provided with the meal are sold together for a single price both are considered part of a “single item” of prepared food and will be taxed at the full state sales tax rate. The pain reliever and cleaning products are non-food items and will be taxed at the full state sales tax rate.

BUTCHER SHOPS / MEAT MARKETS

A butcher shop or meat market is a shop or store devoted primarily to the sale of raw or semi-prepared meat, poultry and seafood products. Eggs, fish, meat, poultry or foods containing these raw animal foods that require cooking by the consumer as recommended by the Food and Drug Administration in Chapter 3, Part 401.11 of the Food and Drug Administration Food Code so as to prevent food borne illnesses are specifically listed in statute as not prepared food. See What Is Not Prepared Food. As a result, raw or semi-prepared meat, poultry, and seafood products sold by a butcher shop or meat market are taxed at the reduced state sales tax rate.

However, butcher shops and meat markets may also sell prepared meat, poultry, and seafood products, along with non-food items (such as cutting boards, knifes, eating utensils, etc.).

Sales of food and food ingredients are taxed at the reduced state sales tax rate. Sales of prepared food items and non-food items do not qualify for the reduced state sales tax rate, and instead are subject to sales tax at the full state rate.

EXAMPLE: At a butcher shop, a customer purchases five pounds of ground beef, a family package of steaks, three whole chickens, and six fish filets. All these items are raw (uncooked). All these items are food and food ingredients and will be taxed at the reduced state sales tax rate because raw meat, poultry, and fish that requires cooking by the consumer are specifically listed in statute as not prepared food. See What Is Not Prepared Food.

EXAMPLE: At a butcher shop, a customer purchases six raw steaks, six pork chops, and three pounds of sliced salami (produced by a manufacturer), which the butcher shop only cuts and repackages. In addition, the customer purchases four ham and cheese sandwiches that are made- to-order and heated by the butcher shop for the customer. The butcher shop does not provide eating utensils. The steaks and pork chops are food and food ingredients and will be taxed at the reduced state sales tax rate because raw meat that requires cooking by the consumer is specifically listed in statute as not prepared food. See What Is Not Prepared Food. The salami is a food and food ingredient because it is only cut and repackaged by the butcher shop. See What Is Not Prepared Food. The ham sandwiches are prepared food and will be taxed at the full state sales tax rate because they are heated by the butcher shop, and/or they are a mixture or combination of two or more food and food ingredients prepared by the butcher shop and sold as a single item. See What Is Prepared Food.

EXAMPLE: At a butcher shop, a customer purchases a whole salami (produced by a manufacturer), a whole bone- in ham (produced by a manufacturer), and a set of kitchen knives. The butcher shop does not provide eating utensils. The salami and ham are food and food ingredients and will be taxed at the reduced state sales tax rate because they are not heated by the butcher shop, they are not a mixture or combination of two or more food and food ingredients prepared by the butcher shop and sold as a single item, and the butcher shop does not provide eating utensils. The knife set is a non-food item and will be taxed at the full state sales tax rate.

EXAMPLE: At a butcher shop, a customer purchases two bottles of steak sauce produced by a manufacturer and two bottles of steak sauce made by the butcher shop. The butcher shop does not provide eating utensils. The two bottles of sauce produced by a manufacturer are food and food ingredients and will be taxed at the reduced state sales tax rate because they are not heated by the butcher shop, they are not a mixture or combination of two or more food and food ingredients prepared by the butcher shop and sold as a single item, and the butcher shop does not provide eating utensils. The two bottles of sauce made by the butcher shop are prepared food and will be taxed at the full state sales tax rate because they are a mixture or combination of two or more food and food ingredients prepared by the butcher shop and sold as a single item. See What Is Prepared Food.

BAKERIES / BAKESHOPS

A bakery is a shop or store that does not produce, but only sells baked goods. A bakeshop is a shop, store, or facility where baked goods are produced and may also be sold.

A baker can bake a wide variety of items, including bread, rolls, pies, cakes, cookies, pastries, donuts, and more. Pastry chefs usually specialize in desserts and may also make non- baked goods as part of their dessert recipes, like custards, sauces, and chocolates.

Bakery items including bread, rolls, biscuits, bagels, croissants, pastries, donuts, danish, cakes, tortes, pies, tarts, muffins, bars, cookies and tortillas are prepared food, but they are not taxed as prepared food if eating utensils are not provided by the seller. Instead, bakery items are treated as a single food item, much like a manufactured food product, regardless of whether the item is produced by a manufacturer or by a retailer. As a result, baked goods sold by a bakery or bakeshop generally qualify for the reduced state sales tax rate. This is true even if the bakery item is heated by the bakery after production.

Bakeries and bake shops may also sell prepared food and non-food items. Sales of food and food ingredients are taxed at the reduced state sales tax rate. Sales of prepared food items and non-food items do not qualify for the reduced state sales tax rate, and instead are subject to sales tax at the full state rate.

EXAMPLE: At a bakery, a customer purchases three loaves of bread, two dozen donuts, a chocolate cake, and an apple pie. The bakery does not provide eating utensils. All these items are prepared food that will be taxed at the reduced state sales tax rate. See Prepared Food Taxed at the Reduced State Sales Tax Rate.

EXAMPLE: At a bakery, a customer purchases an apple pie which the customer asks the bakery to heat. The bakery does not provide eating utensils. The pie is prepared food that will be taxed at the reduced state sales tax rate despite the fact it is heated by the seller. See Prepared Food Taxed at the Reduced State Sales Tax Rate.

EXAMPLE: At a bakery, a customer purchases a slice of pie that is heated and topped with ice cream by the bakery. The bakery does provide eating utensils. See What Is Prepared Food – Eating Utensils “Provided by Seller”. The pie with ice cream is prepared food and will be taxed at the full state sales tax rate because the pie with ice cream is a mixture or combination of two or more food and food ingredients prepared by the bakery and sold as a single item, and/or because the bakery provides eating utensils. See What Is Prepared Food.

DAIRIES

A dairy is an establishment for the distribution and/or production of milk and food products made from milk, such as butter, cream, and cheese and which may also sell eggs. Food that is only pasteurized by the seller, such as milk, and eggs, is not prepared food. See What Is Not Prepared Food. If a dairy uses some of its milk to make other food products, such as cheese, butter, or ice cream, it may or may not be making prepared food. If the process of making the other food product simply changes the form of the milk, the new food product is a food and food ingredient. However, if the process of making the new food product creates a food product that is a mixture or combination of two or more food and food ingredients prepared by the dairy and sold as a single item, such as ice cream, the new food product is a prepared food. Dairies may also sell non-food items.

Sales of food and food ingredients are taxed at the reduced state sales tax rate. Sales of prepared food items and non-food items do not qualify for the reduced state sales tax rate, and instead are subject to sales tax at the full state rate.

EXAMPLE: At a dairy, a customer purchases two gallons of milk and two dozen eggs. Both items are considered food and food ingredients and will be taxed at the reduced state sales tax rate because food that is only pasteurized by the seller, such as milk, and eggs, are not prepared food. See What Is Not Prepared Food.

EXAMPLE: At a dairy, a customer purchases a dish of ice cream (made by the dairy) that is served in a reusable bowl sold separately by the dairy. The dairy does provide eating utensils. See What Is Prepared Food – Eating Utensils “Provided by Seller”. The ice cream is prepared food and will be taxed at the full state sales tax rate because it is a mixture or combination of two or more food and food ingredients prepared by the dairy and sold as a single item, and the dairy provides eating utensils. See What Is Prepared Food. The reusable bowl is a non-food item that is taxed at the full state sales tax rate.

SPECIALTY SHOPS AND STORES

There are a variety of specialty shops and stores that sell various food products. Included in this category are shops and stores that sell some food and food ingredients, but which primarily sell prepared food and non-food items, such as coffee shops, shops that sell edible arrangements of fruit, and ice cream stores.

Also included in this category are shops and stores that sell some prepared food or non-food items, but which primarily sell food and food ingredients, such as chocolate shops, spice shops, olive oil stores, and shops or stores that specialize in baking supplies such as different types of flour, yeasts, sweeteners, icing, etc. Specialty shops and stores may also sell non-food items.

Sales of food and food ingredients are taxed at the reduced state sales tax rate. Sales of prepared food items and non-food items do not qualify for the reduced state sales tax rate, and instead are subject to sales tax at the full state rate.

EXAMPLE: At a spice shop, a customer purchases several bags and bottles of various spices produced by a manufacturer, and two bottles of custom spices that are mixed or combined by the spice shop. The spice shop does not provide eating utensils. The spices produced by a manufacturer are food and food ingredients and will be taxed at the reduced state sales tax rate because they are not heated by the spice shop, they are not a mixture or combination of two or more food and food ingredients prepared by the spice shop and sold as a single item, and the spice shop does not provide eating utensils. The custom spices are prepared food and will be taxed at the full state sales tax rate because they are a mixture or combination of two or more food and food ingredients prepared by the spice shop and sold as a single item. See What Is Prepared Food.

EXAMPLE: At a spice shop, a customer purchases custom spices that are mixed or combined by the spice shop. The spice shop does not provide eating utensils. The price of the custom spice mixture or combination being sold is determined by the weight requested by the customer. The custom spices are prepared food because they are a mixture or combination of two or more food or food ingredients prepared by the spice shop and sold as a single item, but they will be taxed at the reduced sales tax rate because they are sold without utensils, unheated, by weight, as a single item. See Prepared Food Taxed at the Reduced Sales Tax Rate – Unheated Food Sold by Weight or Volume as a Single Item.

EXAMPLE: At a coffee shop, a customer purchases two cups of coffee served with eating utensils, a bag of coffee beans (produced by a manufacturer) to grind and use at home, and one ceramic coffee cup. See What Is Prepared Food – Eating Utensils “Provided by Seller”. The two cups of coffee are prepared food and will be taxed at the full state sales tax rate because they are heated by the coffee shop, and/or they are a mixture or combination of two or more food and food ingredients prepared by the coffee shop and sold as a single item, and/or the coffee shop provides eating utensils (cups). See What Is Prepared Food. The bag of coffee beans is food and food ingredients and will be taxed at the reduced state sales tax rate because it is not heated by the coffee shop, it is not a mixture or combination of two or more food and food ingredients prepared by the coffee shop and sold as a single item, and eating utensils are not provided. The ceramic coffee cup is a non-food item and will be taxed at the full state sales tax rate.

CONVENIENCE STORES

A convenience store is a store with extended hours of operation and in a convenient location, which stocks a limited range of household goods, groceries, and prepared food. Sales made by a convenience store may be of food and food ingredients, prepared food, non-food items, or any combination thereof.

Sales of food and food ingredients are taxed at the reduced state sales tax rate. Sales of prepared food items and non-food items do not qualify for the reduced state sales tax rate, and instead are subject to sales tax at the full state rate.

EXAMPLE: At a convenience store, a customer selects a sandwich (produced by a manufacturer) from the store’s refrigerator case and the convenience store uses its microwave to heat the sandwich for the customer. The convenience store does not provide eating utensils. The sandwich is prepared food because it is heated by the convenience store. See What Is Prepared Food.

EXAMPLE: At a convenience store, a customer purchases a sandwich (produced by a manufacturer) from the store’s refrigerator case. The convenience store does not provide eating utensils. The convenience store does not heat the sandwich, but the customer does heat the sandwich, using the store’s microwave which is available for customer use. The sandwich is food and food ingredients and will be taxed at the reduced state sales tax rate because it is not heated by the convenience store, it is not a mixture or combination of two or more foods and food ingredients prepared by the convenience store and sold as a single item, and the convenience store does not provide eating utensils.

EXAMPLE: At a convenience store, a customer purchases a container of macaroni and cheese (produced by a manufacturer) from the store’s self-serve food area, a botted soft drink, and beer. The convenience store does not provide eating utensils but does make eating utensils available in the self-serve food area. The macaroni and cheese is a food and food ingredient and will be taxed at the reduced state sales tax rate because it is not heated by the convenience store, it is not a mixture or combination of two or more food and food ingredients prepared by the convenience store and sold as a single item, and while made available, eating utensils are not “provided by the seller”. See What Is Prepared Food – Eating Utensils “Provided by Seller”. The bottled soft drink will be taxed at the reduced state sales tax rate because it is defined by statute to be a food and food ingredient. The beer is an alcoholic beverage, not food and food ingredients, and will be taxed at the full state sales tax rate.

FARMERS’ MARKETS

A farmers' market is a community market where local farmers and other producers sell food and food ingredients, prepared foods, and non-food items directly to consumers.

Sales of food and food ingredients are taxed at the reduced state sales tax rate. Sales of prepared food items and non-food items do not qualify for the reduced state sales tax rate, and instead are subject to sales tax at the full state rate.

EXAMPLE: At a farmers’ market a customer purchases a dozen ears of corn, a pound of cherries, three jars of strawberry jam made by the seller, a grilled (heated) hotdog, and an embroidered tea towel. The seller does not provide eating utensils. The corn and cherries are food and food ingredients and will be taxed at the reduced state sales tax rate because they are not heated by the seller, they are not a mixture or combination of two or more food and food ingredients prepared by the seller and sold as a single item, and the seller does not provide eating utensils. The jam is a prepared food and will be taxed at the full state rate because it is a mixture or combination of two or more food and food ingredients prepared by the seller and sold as a single item. See What Is Prepared Food. The hotdog is prepared food and will be taxed at the full state sales tax rate because it is heated by the seller and/or is a mixture or combination of two or more food and food ingredients prepared by the seller and sold as a single item. See What Is Prepared Food. The tea towel is a non-food item taxed at the full state sales rate.

EXAMPLE: At a farmers’ market a customer purchases a package of ripe tomatoes and a potted tomato plant to grow their own tomatoes. The seller does not provide eating utensils. The ripe tomatoes are food and food ingredients and will be taxed at the reduced state sales tax rate because they are not heated by the seller, they are not a mixture or combination of two or more food and food ingredients prepared by the seller and sold as a single item, and the seller does not provide eating utensils. The tomato plant is a non-food item and will be taxed at the full state sales tax rate.

CONCESSION STANDS AND FOOD TRUCKS

A concession stand is a stand or stall at a given location where food, drinks, or other items are sold at a sporting event, theatre, or other venue.

A food truck is a large, wheeled vehicle that contains cooking facilities where food is prepared and from which food is sold, or that contains shelving, bins, freezers, and refrigerators from which food products produced by a manufacturer are sold.

Typically, a concession stand or food truck will sell items that are food and food ingredients and items that are prepared food. A concession stand or food truck rarely sells non-food items.

Sales of food and food ingredients are taxed at the reduced state sales tax rate. Sales of prepared food items and non-food items do not qualify for the reduced state sales tax rate, and instead are subject to sales tax at the full state rate. In the case of a food truck, which is mobile, it is important to note the rate of local sales tax will be based on the location of the food truck when the sale is made.

EXAMPLE: At a concession stand, a customer purchases a heated hotdog, a tub of buttered popcorn, and a fountain drink. The hotdog and popcorn are prepared food and will be taxed at the full state sales tax rate because they are heated by the concession stand, and they are a mixture or combination of two or more food and food ingredients prepared by the concession stand and sold as a single item. The fountain drink is prepared food and will be taxed at the full state sales tax rate because it is a mixture or combination of two or more food and food ingredients prepared by the concession stand and sold as a single item, and the concession stand provides utensils (a cup) for use with it. See What Is Prepared Food.

EXAMPLE: At a food truck, a customer purchases a heated hotdog and a bowl of ice cream served with eating utensils, as well as a cold sandwich and bag of chips (both of which are produced by a manufacturer). See What Is Prepared Food – Eating Utensils “Provided by Seller”. The hotdog and ice cream are prepared food and will be taxed at the full state sales tax rate because they are heated by the food truck, and/or they are a mixture or combination of two or more food and food ingredients prepared by the food truck and sold as a single item, and/or they are sold with eating utensils. See What Is Prepared Food. The sandwich and chips are food and food ingredients because they are not heated by the food truck, they are not a mixture or combination of two or more food and food ingredients prepared by the food truck and sold as a single item, and the food truck does not provide eating utensils.

FULL-SERVICE RESTAURANTS

A full-service restaurant is a place where people sit and eat meals that are cooked and served on the premises. In addition, a full-service restaurant may offer meals for pick-up or delivery. Because the food is prepared, and often heated, by the restaurant for the customer, and the restaurant provides all eating utensils to the customer, the food served in the restaurant is prepared food. A restaurant rarely sells food and food ingredients or non-food items. Sales of food and food ingredients are taxed at the reduced state sales tax rate. Sales of prepared food items and non-food items do not qualify for the reduced state sales tax rate, and instead are subject to sales tax at the full state rate.

EXAMPLE: At a full-service restaurant, a customer is seated and orders a meal to eat in the restaurant. They also order a meal to take out. Both meals are prepared food and will be taxed at the full state sales tax rate because they are heated by the restaurant, and/or they are a mixture or combination of two or more food and food ingredients prepared by the restaurant and sold as a single item, and/ or the restaurant provides eating utensils. See What Is Prepared Food.

EXAMPLE: At a full-service restaurant, a customer is seated and orders a meal to eat in the restaurant. As part of the meal, they also order a bottled soft drink. Although, the bottled soft drink is considered a food and food ingredient if purchased separately, when both the prepared meal and the bottled soft drink provided with the meal are sold together for a single price both are considered part of a “single item” of prepared food and will be taxed at the full state sales tax rate.

FAST-FOOD RESTAURANTS

A fast-food restaurant, also known as a quick-service restaurant, is a specific type of restaurant that serves fast- food cuisine and has minimal or no table service. Dine-in, drive-thru, carryout, or delivery options usually are offered. Food served in fast-food restaurants is typically offered from a limited menu, may be cooked in bulk before it is ordered, and kept hot, finished, and packaged to order, and usually available for take-out, though seating may be provided. The food served in the restaurant is generally prepared food, which does not qualify for the reduced state sales tax rate, and instead is subject to sales tax at the full state rate.

However, a fast-food restaurant may also sell some food and food ingredient items such as milk, juice, bottled water or soft drinks, and ice cream, that are produced by a manufacturer. These are food and food ingredients that qualify for the reduced state sales tax rate. A fast-food restaurant rarely sells nonfood items.

Sales of food and food ingredients are taxed at the reduced state sales tax rate. Sales of prepared food items and non-food items do not qualify for the reduced state sales tax rate, and instead are subject to sales tax at the full state rate.

EXAMPLE: At a fast-food restaurant, a customer purchases a hamburger, fries, and fountain drink combination meal, two chicken sandwiches, and a chocolate shake. The fast-food restaurant provides eating utensils. See What Is Prepared Food – Eating Utensils "Provided by Seller". All the items are prepared food and will be taxed at the full state sales tax rate because they are heated by the fast-food restaurant, and/or they are a mixture or combination of two or more foods and food ingredients prepared by the fast-food restaurant and sold as a single item, and/or the fast-food restaurant provides eating utensils. See What Is Prepared Food.

EXAMPLE: At a fast-food restaurant, a customer purchases an 8 oz. container of milk and a 5 oz. container of fruit that are produced by a manufacturer. The fast-food restaurant provides eating utensils. The milk and juice are prepared food and will be taxed at the full state sales tax rate because the fast-food restaurant provides eating utensils. See What Is Prepared Food – Eating Utensils “Provided by Seller”.

EXAMPLE: At a fast-food restaurant, a customer purchases an 8 oz. container of milk and a 5 oz. container of fruit that are produced by a manufacturer. The fast-food restaurant does not provide eating utensils but does make eating utensils available to customers. The milk and juice are food and food ingredients because they are not heated by the fast-food restaurant, they are not a mixture or combination of two or more food and food ingredients prepared by the fast-food restaurant and sold as a single item, and, while the fast-food restaurant makes utensils available, eating utensils are not “provided by the seller”. See What Is Prepared Food – Eating Utensils “Provided by Seller”.

DELICATESSENS

A delicatessen or, in short, a “deli,” is a store where people can go to buy ready-to-eat items produced by a manufacturer such as cold cut meats, sliced cheeses, sandwiches and salads, and breads, which are food and food ingredients. It may also, or primarily, sell prepared food items such as sandwiches or salads made by the deli, heated sandwiches, items from a salad, food, or buffet line, fountain drinks, etc., which are prepared food. A deli rarely sells non-food items. Sales of food and food ingredients are taxed at the reduced state sales tax rate. Sales of prepared food items and non-food items do not qualify for the reduced state sales tax rate, and instead are subject to sales tax at the full state rate.

EXAMPLE: At a deli, a customer purchases two pounds of sliced ham, two pounds of sliced salami, one pound of sliced cheese (all of which the delicatessen only cuts), a loaf of bread, and a salad, all of which are produced by a manufacturer. The deli does not provide eating utensils. The meat and cheese are food and food ingredients and will be taxed at the reduced state sales tax rate because they are only cut by the deli. See What Is Not Prepared Food. The loaf of bread and salad are food and food ingredients and will be taxed at the reduced state sales tax rate because they are not heated by the deli, they are not a mixture or combination of two or more food and food ingredients prepared by the deli and sold as a single item, and the deli does not provide eating utensils.

EXAMPLE: At a deli, a customer purchases a sandwich and a container of potato salad (both made by the deli), a salad from the deli’s buffet line, and a fountain drink. The deli provides eating utensils. All the items are prepared food and will be taxed at the full state sales tax rate because they are heated by the deli, and/or they are a mixture or combination of two or more food and food ingredients prepared by the deli and sold as a single item, and/or the deli provides eating utensils. See What Is Prepared Food – Eating Utensils “Provided by Seller”.

EXAMPLE: At a deli, a customer purchases two pounds of sliced ham, two pounds of sliced salami, one pound of sliced cheese, (all of which are produced by a manufacturer and the deli only cuts), a sandwich (made by the deli) and a container of potato salad (made by the deli and sold at a standard unit price), and a fountain drink. The deli does not provide eating utensils. The ham, salami, and sliced cheese are food and food ingredients and will be taxed at the reduced state sales tax rate because they are only cut by the deli. See What Is Not Prepared Food. The sandwich, potato salad, and fountain drink are prepared food and will be taxed at the full state sales tax rate because they are heated by the deli, and/or they are a mixture or combination of two or more food and food ingredients prepared by the deli and sold as a single item. See What Is Prepared Food.

CATERED MEALS

By definition, a catered meal is one where the food is prepared by the caterer and all the eating utensils are provided by the caterer. As a result, food provided at a catered meal is considered prepared food. A catered meal does not qualify for the reduced state sales tax rate, and instead is subject to sales tax at the full state rate. It is important to note the rate of local sales tax will be based on the location of the event where the food is served.

EXAMPLE: At a wedding reception, a caterer provides plated meals, a serving line for desserts, coffee, tea or water to drink, and all eating utensils. All the items are prepared food and will be taxed at the full state sales tax rate because they are heated by the caterer, and/or they are a mixture or combination of two or more food and food ingredients prepared by the caterer and sold as a single item, and/or the caterer provides eating utensils for use with them. See What Is Prepared Food.

EXAMPLE: At a catered event, a caterer provides a cash bar that serves beer, mixed drinks, “fountain” soft drinks, and bottled soft drinks. The beer and mixed drinks are alcoholic beverages, not food and food ingredients, and are subject to the Kansas liquor drink tax. The “fountain” soft drinks are prepared food because they are a mixture or combination of two or more food and food ingredients prepared by the caterer and sold as a single item, and the caterer provides utensils (cups) for use with them. See What Is Prepared Food. The bottled soft drinks will be taxed at the reduced state sales tax rate because they are defined by statute to be food and food ingredients. However, if the caterer’s business practice is to physically give or hand eating utensils (such as straws) to all purchasers of drinks, the bottled soft drinks will be prepared food and taxed at the full state sales tax rate. See What Is Prepared Food – Eating Utensils “Provided by Seller”.

MEAL PLANS

A meal plan is a prepaid account individuals can use to buy meals, frequently on a school or college campus or at a facility such as a retirement or senior living center. These plans provide purchasers with the convenience of not having to cook for themselves, buy groceries, or allot a certain amount of money for food each week. Meals purchased with a meal plan will be taxed at the full state sales tax rate because they are heated by the provider, and/or they are a mixture or combination of two or more food and food ingredients prepared by the provider and sold as a single item, and/or the meal provider provides utensils.

EXAMPLE: A college student purchases a meal plan which permits them to have 10 meals in the campus cafeteria. The meal plan will be taxed at the full state sales tax rate because the meals provided are heated by the campus cafeteria, and/or they are a mixture or combination of two or more food and food ingredients prepared by the campus cafeteria and sold as a single item, and/or the campus cafeteria provides eating utensils.

PHARMACY AND NUTRITION STORES

A pharmacy is a store where drugs are offered for sale and where prescriptions are compounded and dispensed. Items dispensed pursuant to a prescription order are exempt from sales tax under K.S.A. 79-3606(p). Over-the-counter drugs (containing a drug facts panel) are considered non-food and subject to the full sales tax rate.

Nutrition stores primarily sell products not considered conventional food that are intended to supplement the diet. These products may be in tablet, capsule, powder, softgel, gelcap, or liquid form. Dietary supplements (containing a supplement facts panel) are considered food and food ingredients and qualify for the reduced state sales tax rate. Some pharmacies and nutrition stores may also sell conventional food and food ingredients and, in some cases, prepared foods. Sales of food and food ingredients are taxed at the reduced state sales tax rate. Sales of prepared food items do not qualify for the reduced state sales tax rate, and instead are subject to sales tax at the full state rate.

EXAMPLE: At a pharmacy, a customer purchases a prescription, a package of over-the-counter pain reduction medication (containing a drug facts panel), and a bottle of vitamin C tablets (containing a supplement facts panel). The prescription is exempt from sales tax. The pain reduction medication is a nonfood item and is taxed at the full state sales tax rate. The vitamin tablets are defined by statute to be food and food ingredients (dietary supplements) subject to the reduced state sales tax rate.